Selecting the best software for your small business’s needs can seem like a challenge with so many options on the market. One well-known program that’s been around for ages is Intuit QuickBooks— in fact, this may be the first program you think of when it comes to accounting software!

QuickBooks isn’t the only option, though. Wave Financial is an up-and-coming software that is becoming popular with many small business owners.

Like many of these accounting programs, they have their fair share of basic similarities. While Wave is free to use for small businesses, QuickBooks offers tools, customizations, and integrations that become essential as your business grows and finances become more complex. When utilized to its full extent with the help of an accounting service or bookkeeper, QuickBooks’ robust features can open opportunities for flourishing businesses looking to gain new ground.

Let’s break down the features, pricing structure, and tools available for each.

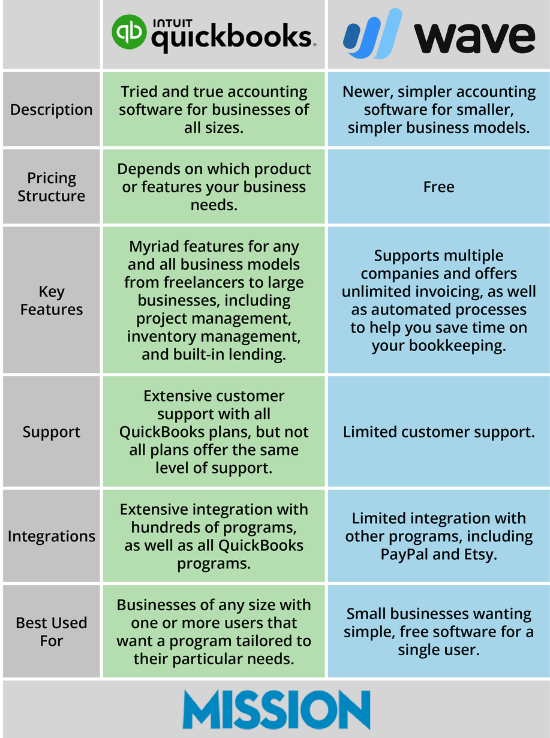

QuickBooks vs. Wave: The Basics

Program & App Integrations

Wave integration currently only supports PayPal, Etsy, and Shoeboxed. However, you can sync it to some other apps, such as Zapier.

QuickBooks supports native integrations with over 600 other business apps. Ranging from payment processing options to customer relationship management systems, QuickBooks’ apps and integrations are above and beyond Wave’s capabilities.

Key Features

Across all of its many plans, QuickBooks boasts a massive array of features. What features exist depends on what plan your business uses, but you can adjust your QuickBooks plan at any time to adjust which premium features you have access to.

A few features that come standard with all versions of QuickBooks include:

- The ability to connect to your business’s bank account

- Take pictures of/upload receipts or proof of transactions

- View outstanding transactions

- Supports multiple businesses in one platform

- Robust inventory management

Wave shares many of these same standard features, but those are more limited than what you’d get from QuickBooks. Among them, Wave’s inventory management features are minimal compared to what QuickBooks offers, and Wave’s project accounting features aren’t comprehensive enough for businesses with more than a handful of employees.

Customer Support

Wave offers email support and additional resources online for anyone that needs a little extra help, but anyone who needs fast support from a customer support specialist may potentially find themselves in a tight spot.

QuickBooks offers the above, as well as phone support, live chat support, and a chatbot so you can talk to a real human in no time. However, some plans have greater access to these features than you would get from the base plans. Regardless, if you need immediate assistance with a problem, QuickBooks makes it easy to find a solution.

Primary Uses

Wave is a solid accounting program for small businesses looking for a free platform to keep their finances in order. It offers a basic array of features and none of the added bells and whistles that may complicate using the program for a new business owner.

QuickBooks’ reputation as a reputable and reliable program is well-earned. No matter what your business’s needs are, QuickBooks has a feature for you. Its robust inventory accounting and project accounting features can help make running your business much easier, especially if you have inventory to keep track of.

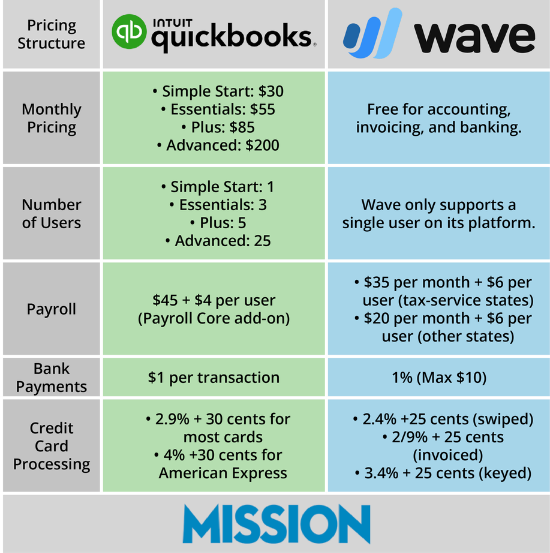

Pricing Structure

Wave’s basic package is free, and you pay monthly fees for programs like Wave Payroll, pay-per-use fees for Wave payments, and additional fees if you decide to work with a Wave advisor.

QuickBooks does not feature a free-to-use program— all their offerings from QuickBooks Self and QuickBooks Essentials to QuickBooks Pro require a monthly subscription. QuickBooks does offer more budget-friendly options, but their most extensive features are limited to higher-tier plans.

Users

Wave’s software is designed for use by a single user. This can be problematic if your financial team includes multiple people.

QuickBooks offers access for up to 25 users, depending on what plan you select.

Payroll

QuickBooks’ payroll add-on comes at a base price of $45 monthly, plus an additional $4 for each additional user. With this, you have access to a simple but comprehensive payroll feature that automatically calculates your payroll taxes and runs payroll automatically.

There are two fee structures in place for Wave’s payroll features. In tax service states, you pay $35 monthly plus an extra $6 per user. In other states, that monthly fee is reduced to $20, as well as the extra $6 monthly for additional users.

Invoicing Features

Need to create an invoice? Both programs allow you to create customized invoices with your company branding. You can also create recurring invoices according to saved client and service details in both Wave and QuickBooks.

Unlike Wave, QuickBooks offers more robust invoice features when it comes to customization and setting up recurring invoices. Notably, QuickBooks also has the ability to calculate the correct tax rate of a sold item based on where you sell and ship your item, saving time and stress from the IRS!

Inventory Management

Perhaps the largest disparity in each platform’s capabilities is their inventory management tools. Wave’s inventory management feature is limited, with no ability to track your inventory stock. QuickBooks, however, offers a wide range of tools ideal for any product-based business.

For example, if your company sells hats online, you will be able to track the quantities of each product and set alerts when your supply of baseball caps is running low. The inventory system is also able to track your cost of goods sold (COGS), again saving you time away from tedious accounting.

Expense Tracking

Both programs include automated expense tracking. QuickBooks also includes added expense tracking features like mileage tracking and receipt capture.

In most QuickBooks tiers, you also have access to small business accounting features that can help make tracking your cash flow much easier. These can include inventory management, bill management, and job costing capabilities.

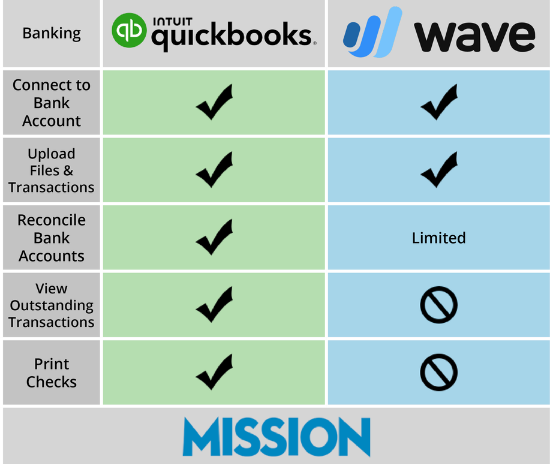

Banking

Both programs can receive online payments, and can allow clients to pay their invoices via ACH, PayPal, and Apple Pay. Both also include debit and credit card processing.

The primary difference in terms of tracking cash between the two is Wave does not allow you to reconcile an account if the check has not yet been cleared by a bank, which can often take a few days. With QuickBooks, you are able to reconcile checks that haven’t yet been processed. This can be especially helpful if your business writes paper checks.

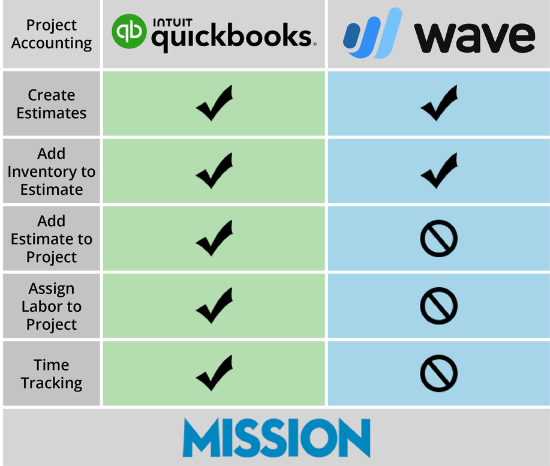

Project Accounting

Project Labor & Estimates

With QuickBooks, you are able to create detailed projects, expenses, and estimates. Wave, on the other hand, does not have any sort of project management tool. If your business focuses on individual projects, QuickBooks is the clear frontrunner when it comes to project management.

Time Tracking

Wave does not include a time-tracking feature, and you will need to keep track of all hours worked manually.

QuickBooks allows you to track billable hours and add them to invoices across all of their program tiers. This feature allows you to create single-time activities or timesheets for each project. This way, your business can easily manage the time spent by your employees or independent contractors.

Accounts Payable

So Which Software Should You Use?

When it comes to your small business, what accounting software you use depends entirely on your unique needs. Both platforms have strong reputations amongst their users.

Are you a freelancer or a business of one that doesn’t need a myriad of complex features? Wave Financial may be more up your alley.

Are you a small business owner looking to expand your business? QuickBooks’ array of features are more dynamic and may be more helpful for larger or growing businesses, especially if you’re working with a bookkeeper or an accountant to keep your finances in order. If there’s a unique feature that you think your business needs, chances are there’s a QuickBooks plan available that has it.

Your accounting software is a vital part of running a successful business. And even though QuickBooks may come with a bit of a learning curve for its staggering amount of features, it is well worth the money when it comes to running your business.

You don’t need to worry though, a little extra help goes a long way in learning the ins and outs of your QuickBooks software.

Want to Get the Most Out of QuickBooks? Trust MISSION Accounting

If your small business needs help getting the most out of your QuickBooks software, MISSION Accounting can help. Our knowledgeable and experienced team can make your company’s bookkeeping much easier and stress-free.

Need help choosing the right QuickBooks software for your business?

When you purchase your QuickBooks software from MISSION, we can help you install it and train your company in how to use it most effectively. Not only can we provide discounts for QuickBooks Online, you’ll also get the valuable insight you’d get when working with a skilled accountant.

Bernard Roesch, MISSION Accounting’s founder, is a Harvard MBA and a QuickBooks ProAdvisor. He has over 25 years of experience in advising his clients and helping them make smart and profitable business decisions.

Contact MISSION Accounting today to schedule a complimentary consultation for your QuickBooks software needs. We can help you find solutions to all your business’s financial needs and take a lot of the stress out of running a small business.