Bookkeeping for a nonprofit takes away from fundraising, spreading awareness, and meeting with potential partners. However, bookkeeping and accounting remains crucial to a nonprofit’s success. While you’re a champion for a great cause, you and your team may be less than heroes regarding how to do bookkeeping for nonprofits.

How to Do Nonprofit Bookkeeping

- Find a bookkeeping solution. A bookkeeper can help select software as well as provide training and support.

- Hire a bookkeeper that has experience with fund accounting

- Establish a bank account for the nonprofit so you’re not mixing personal and business accounts

- Record in-kind donations (goods and services are exchanged rather than money)

- Identify and track budgets

- Create and analyze financial statements

Elect a Treasurer or Financial Officer

Electing an in-house treasurer or financial officer, one who knows how to do bookkeeping for nonprofits, is essential. Furthermore, familiarity with financial software, such as QuickBooks, makes it easier to track purchase orders, in-kind donations, statements of activities, etc.

Establish Bank Accounts

The nonprofit necessitates its own bank account. Mixing personal and business accounts leads to confusion and possible legal issues. Therefore, open separate bank accounts for the nonprofit.

Typically, nonprofits would not hire a fractional CFO, but very much rely on volunteer treasurers. This is where a hired bookkeeper plays an important role in a supporting capacity. A bookkeeper can provide the treasurer with whatever insights he or she needs to deal effectively with the Board and to ensure that long term goals of the nonprofit are met. In particular, treasurers ensure revenue and expenses are in balance and the nonprofit is able to build a financial cushion for rainy days.

Reconcile Accounts

Once you’ve established a bank account and chosen accounting software, align them for reconciliation purposes. If you have not chosen accounting software, need help comparing accounting software features, or think you need to brush-up or train members of the team, a good bookkeeper can take care of that for you. Compare the data in each account against what you have in your books. Reconciling accounts should be a regular activity to track cash flow, identify fraudulent activity, and ensure accuracy.

Fund Accounting

The nature of a nonprofit influences rules and regulations. Fund accounting separates income sources for better clarity and accounting. For example, a college may have separate accounts regarding scholarships and operations.

Purchase Orders

Similarly, nonprofits have rules regarding how money is spent, necessitating a tracking system. A purchase order tells you how much you ordered, what you paid, and when a supplier agreed to deliver goods and services.

In-Kind Donations

A vendor or service provider may lend time or resources, helping your nonprofit as an act of charity. This would be an in-kind donation, viewed differently than a cash donation by the IRS. This is another example of an activity that should be differentiated and properly tracked. A bookkeeper can help define and track fund accounting.

Form a Budget

A nonprofit has different goals as compared to other business types, but a need for an operating budget remains. An operating budget is an overview of operations, usually done quarterly or annually, that projects expenses and income.

What any given nonprofit’s operating budget looks like varies depending on the nature of the organization. This is an area where someone with business experience can help. Projecting expenses and income takes few words to express yet it entails a lot of planning, so direct experience is a huge asset.

Luckily, options exist for nonprofit leaders who need assistance with bookkeeping or require QuickBooks training. Depending on the level of in-house experience, consider hiring a bookkeeper full or part-time. They help select and purchase QuickBooks software, train your team to use financial software, or perform the accounting activities on your behalf.

Create Financial Statements

Creating financial statements is crucial for understanding how much money the nonprofit has accrued, how funds are allocated across bank accounts, and how money got in each account. Financial software can easily generate financial statements, yet there is a learning curve. Statements of financial position, activities, and cash flow are not documents you want a novice to address.

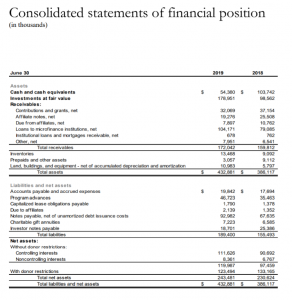

Statement of Financial Position

A nonprofit’s statement of financial position is similar to a for-profit’s balance sheet. It highlights assets, money owed, and the remainder of the two. Unlike for-profits, a nonprofit does not have ‘equity’ but ‘net assets.’ Net assets are left after subtracting liabilities from assets.

Unrestricted net assets have no rules or regulations attached, but restricted net assets must be distinguished and separated. This is a current example of Habitat for Humanity’s financial position:

Statement of Activities

A statement of activities is the nonprofit’s version of a for-profit’s income statement. It gives a view of a nonprofit’s prosperity over a period of time, expressing revenue minus expenses and losses.

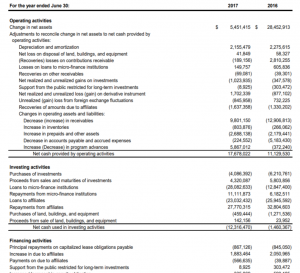

Statement of Cash Flows

This helps track liquid cash generated from operations, investing, and financing. It can be generated from software or a data sheet but it’s not clear and simple. It’s suggested an experienced professional prepares and oversees financial statements. This is a current example of Habit for Humanity’s cash flows report:

Accounting Software for a Nonprofit

A good bookkeeper can counsel you on the best accounting software solution for your nonprofit. QuickBooks works well in addressing all of the above needs and easily integrates with apps and the cloud for up-to-date information. Furthermore, your bookkeeper can train you in using QuickBooks or a particular software solution.

You may be successful in networking with particular software providers who may offer you a discounted rate on software. Otherwise, free accounting options are available but it’s advised that you consult with a professional before making final decisions regarding your nonprofit’s financial software.

Timeline

Meeting with an accountant for taxes may be a quarterly to yearly occurrence but bookkeeping is a regular activity. An experienced professional can handle your books or provide training to address weekly, monthly, quarterly, and annual needs as here:

Weekly

- Adhere to budget goals

- Track purchase orders and fund accounting

- Reconcile bank statements and bookkeeping software

Monthly

- Compare budget against results

- Revise budget where needed

- Analyze and trim fixed costs

- Consider additional funding opportunities

- Seek ways to collaborate in your community

Quarterly

- Report taxes to IRS and submit Form 941

- Prepare quarterly financial statements

- Complete government-related reports for grants or contracts

Yearly

- Submit form 990 to IRS

- Submit payroll information to SSA, IRS, and employees

- Have CPA audit financial statements

- Discuss yearly progress with bookkeeper and develop plan for following year

How to Start a Nonprofit in Connecticut

Name the Nonprofit

Choose a name that complies with Connecticut naming requirements.

The name must be distinguishable from other businesses operating in Connecticut and include an organizational designation (such as “Inc.”).

Choose a Registered Agent in Connecticut

A Connecticut nonprofit needs to nominate a registered agent, an individual or entity receiving legal documents on behalf of the nonprofit, a point of contact with Connecticut.

Select Directors and Officers

The directors form a board and oversee operations and goals. The organization of a nonprofit in Connecticut must include three directors (not of blood relation), a president, and a secretary.

Ready Bylaws and Conflict of Interest

Bylaws and a conflict of interest policy are necessary to apply for 501(c)(3) status. Each must be initiated once a nonprofit’s officers are chosen.

File a Connecticut Nonstock Certificate of Incorporation

To ensure eligibility for 501(c)(3) status, you must file a nonstock certificate, which expresses the organization’s purpose is limited to one of the following:

- Charity

- Religion

- Science

- Education

- Literature

- Youth sports

- Prevention of Cruelty

- Testing or Public Safety

Additionally, it must state what would happen to assets if the nonprofit were dissolved. Assets can be used for approved purposes as outlined by the IRS.

Get an EIN

An employer identification number, or tax identification number, works as your unique ID recognizing the nonprofit as a business entity. It’s required to open a business bank account, for filing federal and state taxes, and hiring employees. Get an EIN from the IRS after establishing your nonprofit.

Apply for 501(c)(3) Status

Once you’ve followed all steps above, file for 501(c)(3) status. File a form-1023 online. When the application is approved, the IRS sends confirmation the nonprofit is exempt from federal taxes as related to section 501(c)(3).

All the above information can be overwhelming, and bookkeeping can be confusing. However, knowledgeable, friendly, and experienced financial experts are waiting to aid on a full or partial basis. Moreover, we can help you make the right decision regarding QuickBooks and financial software as well as train you in using the software to its fullest capabilities. Contact us today to discuss your nonprofit’s needs and how we can help your national or Connecticut nonprofit.