Without consistent financial reporting, even a profitable business can find itself blindsided by cash flow issues and missed opportunities. This is why regularly tracking your finances is more than just a good habit—it’s essential for sustainable growth.

Among many other things, QuickBooks can (and should) be used as a financial reporting software. However, sifting through the countless report options can leave you wondering where to start, and, more importantly, which reports will truly impact your bottom line.

To make this more digestible, we’ve broken the topic of QuickBooks reporting into two articles: operational reporting and essential financial reporting. This article covers the core financial reports—those that provide a clear picture of your business’s profitability, financial position, and cash flow management.

1. QuickBooks Profit and Loss (P&L) Statement

Think of the Profit and Loss (P&L) statement as your business’s financial report card. It doesn’t just tell you whether you’re profitable—it tells you how and why. Imagine you’re running a small retail store, gearing up for the busy holiday season. You’ve invested in extra stock, ramped up your marketing efforts, and hired seasonal staff. But how do you know if all of this is paying off?

By running a P&L report at the end of each month, you’ll get a real-time snapshot of your performance. Is the increase in sales covering the additional costs? If the revenue isn’t growing in line with your expectations, you’ll spot the warning signs early.

This report is your compass, helping you navigate your way to success and steer clear of financial pitfalls.

Key Insights:

- Revenue

- Costs (both fixed and variable)

- Expenses (operating, administrative, and more)

Frequency:

We recommend running this report monthly to stay on top of your business’s financial performance. For businesses experiencing high activity (e.g., seasonal operations or product launches), consider weekly reviews to stay agile and responsive to financial changes.

MISSION Accounting’s Tip:

Regularly compare your P&L across different periods to spot trends and adjust your strategy accordingly. For example, comparing your Q4 P&L with Q3 could reveal whether increased holiday spending translated into proportional revenue growth.

Related Reading: Customizing a Profit and Loss Report in QuickBooks

2. QuickBooks Balance Sheet Report

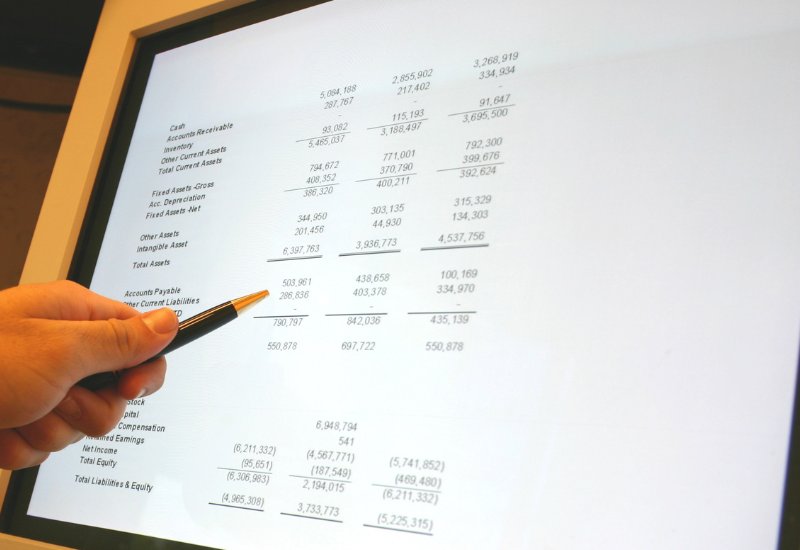

The Balance Sheet is like a snapshot of your business’s financial health at any given moment, showing what your company owns (assets), what it owes (liabilities), and the value left over (equity).

Available in all QuickBooks versions except QuickBooks Solopreneur, running a Balance Sheet before making such big decisions can tell you if you’re financially strong enough to handle new obligations.

Let’s say you’re running a growing business and thinking about taking out a loan or attracting investors. Before making a big decision, you can quickly generate a Balance Sheet in QuickBooks to see if your business is financially strong enough to handle new obligations.

If your business has been consistently profitable, but your liabilities (like loans and payables) have been growing just as fast, you might realize you’re more stretched than you thought. Luckily, QuickBooks allows you to dig into these details easily, showing you when it’s time to slow down on expansion or reassess your financing strategy.

Key Insights:

- Assets: Cash, receivables, inventory, equipment

- Liabilities: Debts, payables

- Equity: What’s left after liabilities are subtracted from assets

Frequency:

We recommend reviewing your Balance Sheet quarterly to assess your business’s overall health. However, if you’re in a growth phase or considering major financing decisions, running it monthly in QuickBooks can help you stay ahead of any potential financial risks.

MISSION Accounting’s Tip:

Use the current ratio (current assets divided by current liabilities), which QuickBooks calculates for you, to regularly check your liquidity. A ratio below 1 may signal cash flow issues, while a ratio above 1.5 ensures you’re in a comfortable financial position.

3. QuickBooks Cash Flow Statement

The Cash Flow Statement is your business’s reality check—it shows how money moves in and out of your accounts, providing critical insight into your liquidity. Even if your business is profitable on paper, cash flow issues can sneak up and cause serious problems, like struggling to pay bills or employees.

By regularly reviewing your Cash Flow Statement in QuickBooks, you’ll see whether you have enough cash to meet short-term obligations like payroll and rent, or if you need to take action to collect receivables faster.

Because QuickBooks allows you to break down cash flow by operating, investing, and financing activities, you can pinpoint exactly where cash flow issues are occurring. You can also compare this report with your P&L to get a full picture of whether your profits are translating into actual cash in the bank.

Key Insights:

- Operating activities: Cash from core business operations, like sales and payments to vendors.

- Investing activities: Cash spent on or generated from investments, such as equipment purchases or asset sales.

- Financing activities: Cash from loans or equity financing and repayments.

Frequency:

We recommend running the Cash Flow Statement monthly to ensure you always know where your money is going. However, during periods of tight cash flow or rapid growth, consider reviewing it weekly to catch problems early.

MISSION Accounting’s Tip:

Use the Direct Method (offered in QuickBooks) for a more straightforward view of cash transactions, especially if you’re a small business dealing with direct income and expenses. It’s also a good idea to set up cash flow projections in QuickBooks, which use past data to predict future cash flow.

Related Reading: Managing and Improving Your Cashflow Situation

4. QuickBooks Accounts Receivable (A/R) Aging Summary

The Accounts Receivable (A/R) Aging Summary is a vital tool for tracking unpaid customer invoices and ensuring your business stays cash-flow positive. Think of it as your “money waiting to be collected” report. If customers aren’t paying you on time, your business could face cash flow problems even when sales are strong.

The A/R Aging Summary in QuickBooks Online or Desktop helps you identify late-paying customers, so you can follow up before cash flow becomes an issue.

For example, if you see that 50% of your outstanding receivables are 60+ days overdue, it’s time to prioritize contacting those clients. You can use the report to identify habitual late payers and consider adjusting their payment terms.

Keep in mind, in QuickBooks, you can also set automated payment reminders for invoices that are approaching or have passed their due date.

Key Insights:

- Outstanding invoices, grouped by how many days overdue they are (e.g., 0-30 days, 31-60 days, etc.).

- Total amount owed by each customer.

- Helps you spot which clients consistently pay late, allowing you to refine your payment terms or strategies.

Frequency:

We recommend running the A/R Aging Summary weekly to ensure you’re proactively managing overdue accounts. During busy periods or if you offer longer payment terms, you may want to check it even more frequently to avoid cash flow surprises.

MISSION Accounting’s Tip:

Use QuickBooks’ collections management tools to send gentle reminders before invoices are overdue. For chronic late-payers, consider offering early payment discounts or adding late fees through QuickBooks to incentivize timely payments.

Related Reading: How to Streamline Accounts Receivable Reminders in QuickBooks

5. Accounts Payable (A/P) Aging Summary

Unlike the A/R Aging Summary, which helps you manage what’s owed to you, the Accounts Payable (A/P) Aging Summary shifts the focus to what you owe to others. Think of it as your roadmap for what you owe and when it’s due.

For example, if you run a small manufacturing business, juggling multiple vendor invoices, this report helps you prioritize which payments to make to avoid late fees or strained supplier relationships.

If your A/P Aging Summary shows that a significant portion of your payables is overdue, it can signal cash flow problems or disorganization in managing your liabilities—both of which can damage your reputation and lead to financial trouble.

Key Insights:

- Outstanding bills sorted by aging periods (e.g., 0-30 days, 31-60 days).

- Total amounts owed to each vendor.

- Helps you identify overdue payments and prevent late fees or credit issues.

Frequency:

We recommend running this report weekly to stay ahead of upcoming payments. This frequency allows you to prioritize bills and manage your cash flow more effectively.

MISSION Accounting’s Tip:

Set up automated bill payments through QuickBooks to ensure you never miss a due date. Regularly reviewing this report will not only help you avoid late fees but also strengthen your relationships with vendors, potentially leading to better terms or discounts for timely payments.

Related Reading: How to Simplify Your Accounts Payable Process

The Importance of Accuracy and Automation in QuickBooks Reports

The power of QuickBooks reports lies in their ability to provide a clear and detailed picture of your business’s financial health. However, this only holds true if your reports are accurate. Any inaccuracies, whether from data entry errors or misconfigured settings, can lead to incorrect financial insights.

One of the biggest challenges businesses face is ensuring that automation—a key strength of QuickBooks—is properly set up. Automated tasks like invoice tracking, expense categorization, and payment reminders are essential for generating accurate reports, such as the Cash Flow Statement and A/R Aging Summary.

So, if your automation isn’t configured correctly, overdue invoices might not show up in your A/R Aging Summary, leading you to believe your receivables are in better shape than they actually are.

Why Expert Guidance is Essential For Consistent Financial Reporting

This is where expert guidance comes in. At MISSION Accounting, we specialize in setting up QuickBooks to ensure that all automated tasks—such as categorizing transactions and tracking receivables—are configured properly from the start.

We tailor your system to your specific business needs, ensuring your reports are not only accurate but also customized to provide the insights you need. We don’t just stop at setup—we help you understand and interpret your reports, offering actionable insights that allow you to make informed financial decisions.

Ready to ensure your QuickBooks setup is accurate and working to its full potential? Reach out to MISSION Accounting today for a free consultation.

Let us help you get the most out of your QuickBooks reports and guide you toward smarter financial decisions.