Let’s imagine you are running a lemonade stand. Your business is new, your transactions are low, and all you need to account for is revenue and expenses to determine your profit. For the time being, you have no need for a double-entry bookkeeping system and can simply record transactions individually.

Lo and behold, your lemonade business finds surprising success within your local community. You expand your new citrus empire by taking out a loan for a new lemonade stand across town, begin to purchase lemons in bulk, and hire additional employees. Suddenly, managing your assets and liabilities becomes far more complex as you need to account for each debit and credit transaction.

Deciding on a double-entry bookkeeping system is not a question of “if,” but “when,” and the answer is almost always “now!” Chances are, your business is already utilizing a double-entry bookkeeping system, but you may not be taking full advantage of your financial reporting.

It doesn’t matter how great your service or product is, or how effective you or your team are at selling if you’re not able to properly account for your debits and credits to make sound financial decisions.

Maintaining accurate books is vital for your business to function, and thrive with a healthy and robust cash flow. This happens by implementing a bookkeeping system that accurately tracks your financial transactions and invoices.

How Is Double-Entry Bookkeeping Different from Single-Entry Bookkeeping?

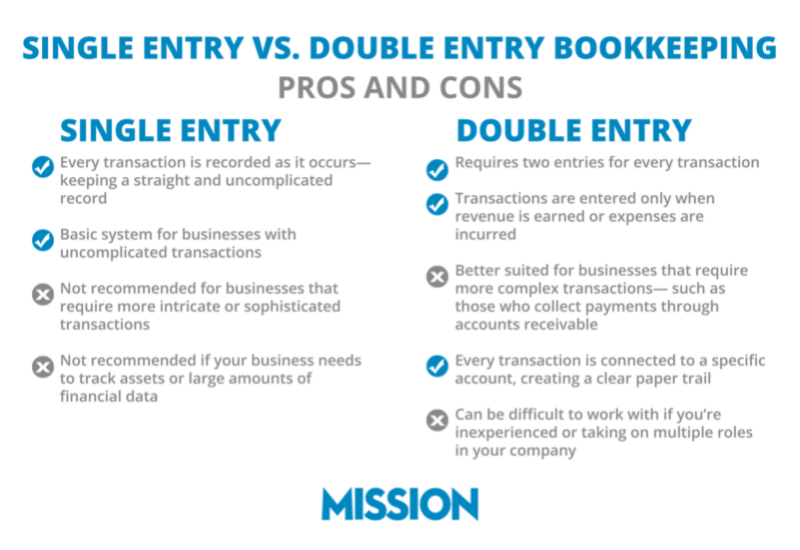

There are two types of bookkeeping systems that your accountant or bookkeeper can use to calculate your company books and present your financial statements. These are known as single-entry and double-entry bookkeeping.

Single-Entry Bookkeeping

As the name implies, single-entry bookkeeping entails recording a single entry for each financial transaction or activity within your company. Each transaction is recorded as it occurs on a ledger, keeping a straight and uncomplicated record for when it’s time to compare your books with your bank account.

Single-entry bookkeeping is a fairly basic system that can be used to record daily receipts or create short-term cash flow reports. Simply put, if your business is larger than a lemonade stand with need to track assets and liabilities, single-entry bookkeeping will not be a sufficient enough method of accounting.

Double-Entry Bookkeeping

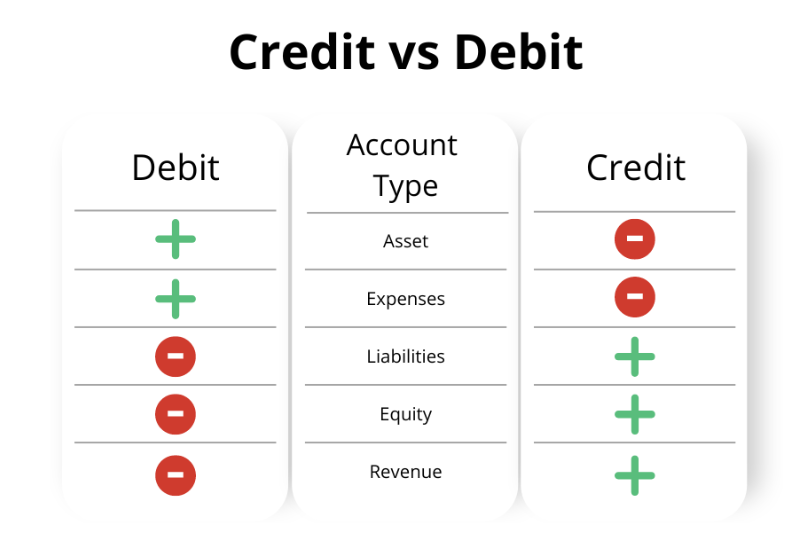

Also known as double-entry accounting, this system requires two entries for each financial transaction: debit and credit. Double-entry bookkeeping provides a “checks and balances” system by separately keeping track of each credit entry and each debit entry.

Each transaction is listed as either debit or credit, and the second entry connects that transaction to a specific account.

In a double-entry system, the amounts recorded as debits must be equal to the credit amount recorded on the ledger because each credit transaction will have an opposite impact on the other. This allows you to keep track of accounts receivable, accounts payable, assets, liabilities, and equities all in one place.

For example, if you buy a new laptop for your business for $500, you would credit your expense account for $500 and debit your cash account for $500. This creates a clear paper trail, allowing you to have a clear and specific account of all transactions in your financial records.

Why Should I Use A Double-Entry Bookkeeping System?

Double-entry bookkeeping is considered the global standard for business accounting and is essential for your business to keep its accounts balanced and organized. With the proper setup, any inconsistencies or errored entries are easily detectable and can be settled accordingly.

Whether you are starting, merging, or acquiring a business, an accurate and thorough balance sheet can help determine your business’s financial state and needs.

Despite being more complex, a double-entry system makes your financial reporting easier by allowing you to generate a statement of cash flows, balance sheets, and detailed income statements.

These generated financial statements decrease the risk of bookkeeping errors while increasing the financial transparency of your business. In addition, a double-entry system will be required if your business needs to acquire a loan, create a financial statement, or prepare for an audit.

Do I Need A Bookkeeping Software?

Double-entry bookkeeping is often done through accounting software that can remove many of the more tedious aspects of manual bookkeeping.

These programs make organizing your business’s financial data easier, faster, and more convenient. Using accounting software for your business cuts down on redundant data entry, makes it easier to determine cash flow, and enables you to better manage inventory and sales.

A lot of accounting software can be customized to suit your business needs, regardless of your business environment or financial situation.

A small business can use accounting software to generate invoices, calculate employee costs, and calculate sales tax.

A larger business with more complex accounting can use it to determine revenue streams, send batch invoices, and automate accounting tasks.

Although there are many accounting software options available, we highly recommend Intuit QuickBooks for all business accounting services.

How Does QuickBooks Use Double-Entry Bookkeeping?

QuickBooks uses double-entry bookkeeping exclusively and offers a number of robust tools and data at your disposal. QuickBooks also offers a number of accounting products best suited for your business needs whether you are a small business, working in a niche industry, or an enterprise.

QuickBooks is focused on customizable accounting software that allows you to organize and generate your business financials seamlessly.

Within the double-entry bookkeeping system QuickBooks provides, you are able to integrate other services such as PayPal, Square, and Shopify, so your financial transactions are kept in one place.

Utilizing the tools, features, and resources QuickBooks provides can be a game-changer for your business, but we find that many business owners have trouble managing their bookkeeping and often find themselves behind in keeping track of their expenses and cash flow.

Without the proper setup and due diligence, it can be near impossible to keep your accounting balanced and up to date. This can leave you behind in recording transactions, with little idea of the actual financial health of your business.

While it’s important to get the most out of the software you’re already paying for, it is paramount that you are diligent in your accounting in order to keep your business running.

When Should I Hire a Bookkeeper?

Often times when business owners come to the realization that they need to hire a bookkeeper or accounting service, the business accounting is already far behind in achieving the goals discussed above.

Here’s how to tell when you should hire a bookkeeper:

- Your business is experiencing growth

- You don’t have any help in balancing the books or calculating cash flow

- Your business is behind in sending invoices or payments

- You require faster access to accounting information

If you’re experiencing any of these problems, that’s a good indication you can benefit from a bookkeeper’s services.

You don’t have to wait until your business gets behind, or isn’t properly tracking all of its financial transactions. Being proactive can help save you time and money.

Looking for Bookkeeping Solutions? Trust MISSION Accounting

Proper bookkeeping is vital to your business’s success. If you’re looking for expert bookkeeping services that can help your business run smoothly, MISSION can help.

Our team of bookkeeping and QuickBooks experts can help you reconcile your bookkeeping accounts, track inventory, analyze your revenue and expenses, and more. And if your business wants to use QuickBooks software, MISSION can help you get it set up and provide training for your team.

Need to purchase QuickBooks software? We can help you there too.

Don’t risk letting your financial records get away from you. A knowledgeable bookkeeper can be the difference between a business that thrives, and one that struggles.

Bernard Roesch, MISSION Accounting’s founder, is a Harvard MBA and a QuickBooks ProAdvisor. He has over 25 years of experience in advising his clients and helping them make smart and profitable business decisions. He and his team of QuickBooks experts can also help you choose the right QuickBooks version and help your business unleash the full power of QuickBooks to help your business and its finances thrive.

Contact us at Mission Accounting today to schedule a complimentary consultation for your small business’s bookkeeping needs. Let’s find a solution together.