We’ve talked a lot about the importance of accurate financial reporting, but that all starts with navigating and maintaining your business’s general ledger.

A general ledger report is essentially the full record of transactions that took place with each account. This double-entry system provides detailed information regarding each transaction keeps track of which accounts were credited and which were debited. Knowing how to navigate these reports is vital to keeping up-to-date and balanced books within your small business. You could theoretically keep track of this information in a Google sheet, but why would you want to when a better, smarter option exists?

Thanks to your QuickBooks accounting software, keeping track of your general ledger report and using it to create financial reports is a process. However, creating the ideal structure for your general ledger can be tricky if you want to track inventory, vendors, and other transactions that facilitate sound business decisions.

Let’s start with a few basics.

How to Find Your General Ledger Report in QuickBooks

Your general ledger (G/L) report in QuickBooks shows each account’s beginning balance, all activity (debits and credits), and the ending balance over your chosen period. It’s one of the most fundamental reports for reviewing your books. In QuickBooks Online, generating it is easier than ever.

Here’s how to access the General Ledger report in QuickBooks Online:

-

Go to Reports in the left-hand menu.

-

In the “Find report by name” or standard reports list, scroll to or search for “General Ledger” under the For My Accountant section.

-

Click General Ledger to open the report.

-

Use the date selector to pick your report period.

-

If you’d like, click Customize to filter by account, include or exclude columns (e.g. Debit, Credit), or choose between cash or accrual basis.

-

Click Run report to display your results.

-

Optional: Export to Excel or PDF, or print.

Because QuickBooks Online updates the report dynamically, you always see live data—and you can adjust filters or date ranges on the fly.

Using Your General Ledger Report for Accurate Bookkeeping

Your QuickBooks general ledger report is vital for accurate bookkeeping because it can help break down each of your company’s asset accounts individually. Typically, the process goes something like this:

- Gather transaction documents, such as invoices and receipts.

- Record this in a general journal entry. This should include each major transaction detail like date, the dollar amount, and what the transaction entailed (i.e., purchasing inventory, selling product, et cetera). This transaction list keeps all this vital information organized in a single place.

- Record each journal entry in your general ledger, which you can easily do in QuickBooks.

When you keep track of your various accounts this way, your accountant can produce financial statements that accurately display every account and their respective balances. This provides an overall view, allowing you to see where your business is doing well— or if it’s struggling.

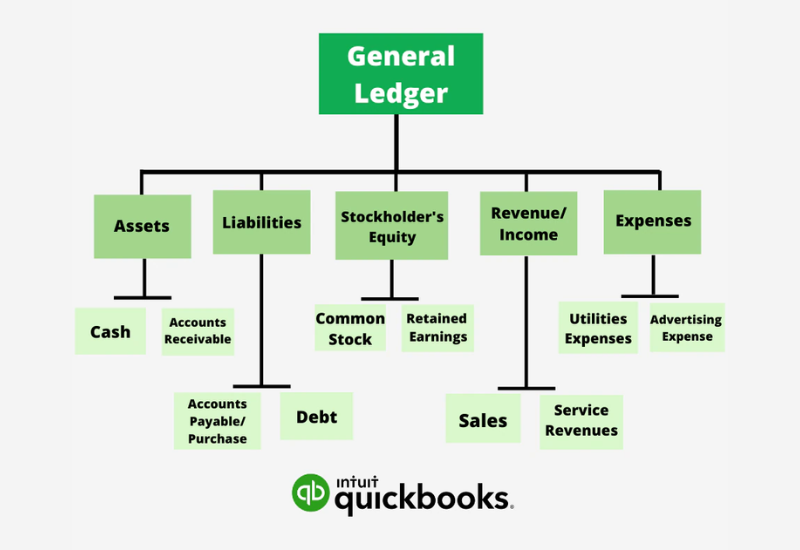

Your general ledger accounts include five account categories total. Your balance sheet will use three of these categories— assets, liabilities, and equity. Your income statement will include the other two— expenses and revenue.

Let’s take a look at these in a little more detail.

Assets

Assets are the resources your business uses to generate revenue. This can include physical items like inventory, equipment, and property. It can also include other resources like patents and trademarks. The asset ledger allows you to track your fixed and long-term assets, and break them down into specific categories.

Liabilities

Liabilities are essentially money owed by your business to others. This can include loans, leases, and employee payroll. Just like the assets ledger, you are able to categorize your liabilities. From amounts owed to suppliers, income taxes, owed to wages, and income taxes, this ledger paints a clear picture of your financial liabilities.

Equity

Equity is what money remains after accounting for your assets and liabilities. For example, if your assets are more profitable than your liabilities are costly, you have higher equity. There are 3 components to your business’s equity balance:

- Common stock or owner’s equity. This varies on whether or not your company has stocks. If you do, your equity includes common stock, or the number of shares multiplied by their par value. If your company does not have stocks, you use owner’s equity, or the business owner’s total stocks and assets.

- Additional paid-in capital, or how much investors pay for common stock above their par value.

- Retained earnings. These are subtracted from your business’s total earnings to pay dividends to your shareholders.

Expenses

You can’t make an omelet without breaking a few eggs, and you can’t earn revenue without incurring some expenses. The general ledger provides you with an overview of your expenses from each accounting period.

Revenue

Of course, revenue is the income generated by your business. This not only includes selling product, but also any royalties you may incur, or fees paid to your accounts receivable.

So What Do I Do With All This Information?

All this information goes towards creating financial statements that give you an accurate representation of your business’s finances. Using this double-entry system accounts for the ebb and flow of your money so that you always know how much is coming in or going out.

Your general ledger report includes vital information like liabilities and equity to paint a clear picture of your company’s assets. This allows you to quickly pinpoint sudden rises in expenses, unexpected changes in inventory, or accounting errors.

To get the most bang for your buck with your general ledger, you’ll want to hire an experienced bookkeeper or accounting service to keep track of those numbers and monitor them for anything peculiar or potentially troublesome. This process can be even more efficient if you’re using the right software, like QuickBooks.

Hedge Against Disaster with Your General Ledger Report

There are two sides to every story. This doesn’t mean that one side is right and the other wrong, rather, they are two parts of the same truth. When it comes to your small business, this is where your general ledger report comes in.

Finding and utilizing your QuickBooks general ledger report is simple, and it’s vital for accurate bookkeeping. There is a large range of QuickBooks accounting software to choose from to help run your business. It can be tricky getting the full use of your software if you’re not sure how it works though. This is where MISSION Accounting can help.

Whether you’re looking for bookkeeping solutions or want to unleash the full power of QuickBooks, we can help you every step of the way.

Our team of QuickBooks experts can help you choose the right version of QuickBooks for your business. When you purchase your preferred QuickBooks software from MISSION, we can help you install it, assist you in getting the most out of your software, and train your company in how to use it.

Bernard Roesch, MISSION Accounting’s founder, is a Harvard MBA and a QuickBooks ProAdvisor. He has over 25 years of experience in advising his clients and helping them make smart and profitable business decisions.

Contact Mission Accounting today to schedule a complimentary consultation for your QuickBooks software needs. We’re here to help you find solutions to all your business’s financial needs and help make running your business as smooth as possible.