Accurate financial reports act as your business’s bill of health, and software such as QuickBooks manages the finances that help your business get a loan.

If your business was a car, your financial reports are your dashboard. A crucial provider of data to keep you on the road, but one malfunction can leave you stranded and begging friends for help.

With expenses like bills, rent, inventory, and employee wages, the costs of running a business can add up quickly— especially if you’re still getting started or if you’re looking to expand your business.

This is where obtaining a small business loan can provide your company with a much-needed financial windfall. A small business loan can help give your business an excellent springboard for success. Of course, a loan isn’t free money, and you need to be smart about how you use your loan, as well as how to apply for one.

You’re not guaranteed approval just because you apply, so how do you improve your chances of getting approved? This is yet another area where your company’s bookkeeping can determine success or failure.

Whether you’re getting a loan to fund a marketing campaign, cover unexpected expenses, or expand inventory, your chances of approval will rely on your business’s financial reports.

An unlikely but nonetheless helpful resource is actually your accounting software— or more specifically, Intuit QuickBooks. QuickBooks Capital can help you apply for the best small business loan for your company and help your business succeed. The best way to do this is to use QuickBooks to keep track of your business’s cash flow and financial health.

Before we talk about how managing QuickBooks can help your business get a loan, let’s take a look at what kinds of loans it can help you get.

5 Types of Small Business Loans

There are five most common forms of small business loans that have varying requirements and structures. However, each relies on well-documented and detailed financial reports

SBA Loans

An SBA loan (small business administrator loan) is funded through a small business lender and is backed by the US government. For-profit businesses that do not exceed a certain number of employees or annual receipts can qualify for an SBA loan.

Because of the low interest rates of SBA loans, the approval process can be tiresome and require a strong credit history and detailed profit forecasting.

Traditional Loans

Also known as traditional business loans, these are loans that are offered directly through banks and other financial institutions. These loan amounts can depend upon a few factors, such as the lender’s size and specific requirements, and your business history.

A traditional bank loan may be more flexible than an SBA loan, but a bank will often ask for more in-depth financial reporting, such as your debt-to-asset ratio and in-depth income reports.

Specialty Loans

Similar to an SBA loan, a specialty loan supports specific groups, such as women or minorities, or causes like nonprofits. If you or your business meet the proper criteria, then you can apply for this means of financing. These loans are often reserved for underserved demographics or noble causes.

Specialty loans have firm restrictions on how you can spend borrowed funds. For example, if your nonprofit is approved for a loan to expand your reach to underserved youth, you will be restricted from using the loan for marketing purposes.

Business Lines of Credit

A business line of credit works a little differently than the other loans on this list. Once you’re approved, you have access to those funds. While your withdrawals are limited to only the money you currently need, you only need to pay interest on the money borrowed, rather than the full funds allocated.

Business lines of credit often require you to provide an asset as collateral, which can limit your ability to secure financing from other sources.

Invoice Factoring

This isn’t technically a business loan, but it can be a viable option if your business needs some cash.

Invoice factoring involves selling your accounts receivable to a third party who, in exchange, pays your business 80 to 90 percent of your invoice amount.

How Managing QuickBooks Can Help Your Business Get a Loan

Maintaining accurate and up-to-date financial reports is essential for every facet of your business to run smoothly. Precise bookkeeping enables you to determine the health of the company and make sound decisions, while investors and banks will use your business’s financial reports to guide their decisions.

Lenders depend on your ability to produce these financial reports as they will be the driving factor in evaluating your loan liability. Accounting software like QuickBooks can be your greatest tool when creating faultless financial reports needed to secure a loan.

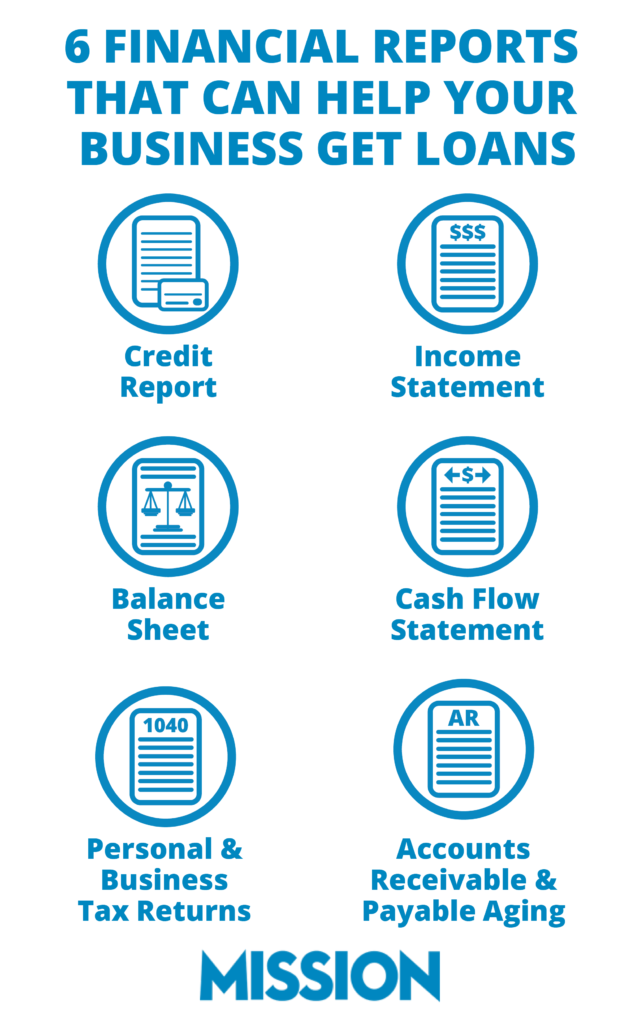

Along with a business plan and loan proposal, these reports required may vary by lender, but these requests are likely to include:

- Credit report: Your personal and business credit reports give lenders an idea of how you handle debt. Many lenders have a minimum credit requirement that must be met before considering a loan.

- Personal and business tax returns: Tax returns are used to double-check the accuracy of your business’s financial reporting. Lenders will compare your income statements and cash flow statements to your tax returns to make certain there are no disparities. This is why producing accurate reports to your potential lender is so essential.

- Income statement: While a credit report paints a picture of your ability to manage debt, a lender will want to make sure your business is profitable. An income statement details the profitability of a business by comparing your revenue to your expenses.

- Balance sheet: Your balance sheet is an up-to-date summary of your business’s assets, liabilities, and capital. Lenders use this information to view your cash on hand, determine any necessary collateral, and confirm your ability to make loan repayments.

- Cash flow statement: Your cash flow statement gives lenders an idea of the cash flowing in and out of your company. This may include ongoing operations and external investments, and lenders can use your net income and overall cash generated to determine whether your business growth is healthy enough to repay the loan. You can also use QuickBooks cash flow reports to forecast any potential financial issues.

- Accounts receivable and payable aging: These reports show vendors how long it takes for a customer to pay their bills and how long it takes your business to pay vendors. A lender will be able to confirm that both your and your customers are paying for services and products on time. Failures or unexpected delays on either end can be a red flag for anyone determining your loan viability. Want to learn how to streamline accounts receivable with QuickBooks? Check out our article on the topic!

Your QuickBooks software of choice can make small business accounting significantly easier and infinitely more organized. When you have robust and organized financial records, then loan providers are much more likely to not just consider your application but approve your loan as well.

What About Invoice Factoring?

Invoice factoring isn’t like the other loans, but QuickBooks users can access this option directly through QuickBooks Payments via Get Paid Upfront invoices.

Want to Get the Most Out of QuickBooks? Trust MISSION Accounting

Remember, if your business is like your car, your financial statements are your dashboard. This information is always right at your fingertips, and it’s crucial for keeping operations running smoothly. But if you don’t keep tabs on everything, you can put your business and yourself in a tough spot. Thankfully, your QuickBooks software can help.

The range of QuickBooks software can make keeping track of your finances infinitely easier, but it can be intimidating to get started with such a huge amount of features at your fingertips.

Don’t worry though. Whether you’re looking for bookkeeping solutions or want to unleash the full power of QuickBooks, MISSION Accounting can help.

Our team of QuickBooks experts can help you choose the right version for your business. And when you purchase your preferred QuickBooks software from MISSION, we can help you install it, assist you in getting the most out of your software, and train your company in how to use it.

Bernard Roesch, MISSION Accounting’s founder, is a Harvard MBA and a QuickBooks ProAdvisor. He has over 25 years of experience in advising his clients and helping them make smart and profitable business decisions.

Contact MISSION Accounting today to schedule a complimentary consultation for your QuickBooks software needs. We’re here to help you find solutions to all your business’s financial needs and make keeping track of your finances infinitely easier.